Home » Broker » Second Charge Mortgages » Second Charge Broker Resources

Second Charge Broker Resources

Find broker FAQs and resources to help you with your customer’s Second Charge mortgage application.

General Second Charge Broker FAQs

Sorry, registration for our panel is currently closed.

We don’t currently lend for our second charge mortgage products in Northern Ireland but we do lend in mainland Scotland and some of the islands.

We use Equifax credit reports when assessing a mortgage application.

Commission is paid via EFT and the payment runs are twice weekly.

We’d be happy to review the case. Please submit a referral, by emailing the referral team at [email protected]

We will consider further advances once the account has been running for 6 months, subject to underwriting.

Yes, we will. We can lend on ex houses and flats on referral and pre-emption is ignored.

Many cases can go through without the need for a valuation however if a valuation is required, we have a valuation panel that must be used.

All updates are sent through our portal.

Many cases can go through without the need for a valuation however if a valuation is required, we have a valuation panel that must be used.

We will speak to all applicants prior to the mortgage offer being produced.

e-signature Broker FAQs

We understand the importance of time to you and your customers. Improving time efficiency whilst reducing the need to print and post documents is not only better for you and your customers but it’s also better for the environment.

Pepper Money provides your customers, who meet our criteria the option to digitally sign select documents. To support you we have compiled the FAQs below.

Your customers will be eligible if:

- their security property is registered in England or Wales;

- they have their own unique telephone number and email address;

- they do not require independent legal advice; and

- they haven’t been identified as having low computer, financial, or English language literacy.

Ineligible customers will continue to receive a paper copy of the Offer Pack and Deed directly from Pepper Money in the post, with a requirement for the Deed to be signed and a hard copy original returned to Pepper Money via the post.

If your customer does not wish to proceed with the e-signature process, you will be able to obtain the Offer documents (including the Application Summary) directly from SWAN and send them to your customer via email or post. Your customer would then need to sign the documents and return hard copies to Pepper Money via the post. If we or you identify your customer as having low computer, financial, or English language literacy then they will not be eligible for the e-signature process and they will be issued their offer documents by post and email for signing, witnessing and returning.

The following documents can be signed as part of the e-signature process:

- Mortgage Deed

- Credit Consolidation & Cash Out Form

- Minor Amendments Form

- Direct Debit Mandate

- Application Declaration

Yes, in order to properly execute the Mortgage Deed, a witness who must know the customer but must not be their relative or live in their property, will need to be present to witness the e-signing of the Mortgage Deed. Your customer will need to provide the full name, email address and mobile number of their witness as part of the Mortgage Deed e-sign process. This is so the witness can be sent the Mortgage Deed to e-sign (witness).

Once the application goes to Offer and the offer documents have been sent to Robertsons, your customer will receive their invite to e-sign their documents within 3 working hours (based on standard business hours of 9am-5pm Monday to Friday).

Robertsons Solicitors act solely on Pepper Money’s behalf as part of the conveyancing process. We have instructed Robertsons Solicitors to act on our behalf and manage / control the e-signing process to make this as smooth as possible for your customer. This is the reason your customer will receive the DocuSign email from Robertsons Solicitors branded Pepper Money.

No, their signature must be witnessed by an independent witness who knows them, who is not their relative and does not live with them.

Yes, joint customers can use the same witness.

Yes, for married/sole customers who want to e-sign we will need the Consent Deed returned to us before offer. If we have to send the Consent Deed with the offer customers will not be eligible for e-sign.

In this instance, your customer should contact Robertsons Solicitors (the solicitors acting on Pepper’s behalf and who are helping us manage the e-signing process). To do so customers can email [email protected]. Robertsons will then correct the information so your customer can proceed with the e-sign process.

In this event, the customer should check whether the witness for applicant 1 has completed their part of the process, because if they haven’t, then the email will not be sent to applicant 2. If Applicant 1 and their witness have completed their part of the journey and an email has still not been received by applicant 2, they should check their junk email box. If the email can still not be traced they should contact Robertsons Solicitors via email at [email protected].

Customers are signposted to their broker if there are any issues with errors on the documents (incorrect term, product, advance etc). You can then carry out the changes needed and communicate with us where necessary. If the offer is amended, our underwriter will resend the amended offer documents to Robertsons Solicitors so that they can reissue them to the customer(s) for e-signing.

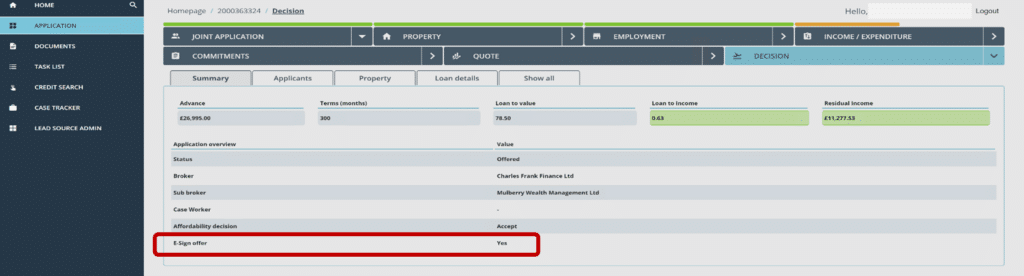

Via Swan, once the case has been moved to ‘’Awaiting Offer’, you can see whether the case is eligible for the e-signatures journey by looking at the ’E-Sign Offer:’ field within the ‘Decisions’ tab.

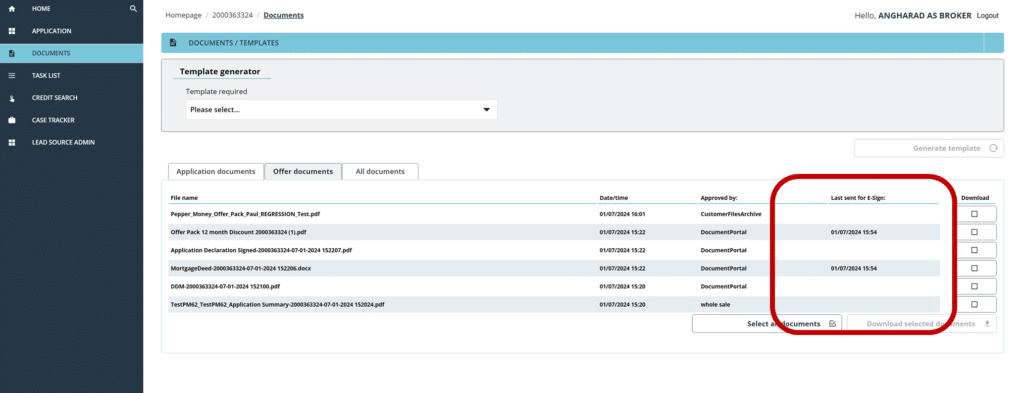

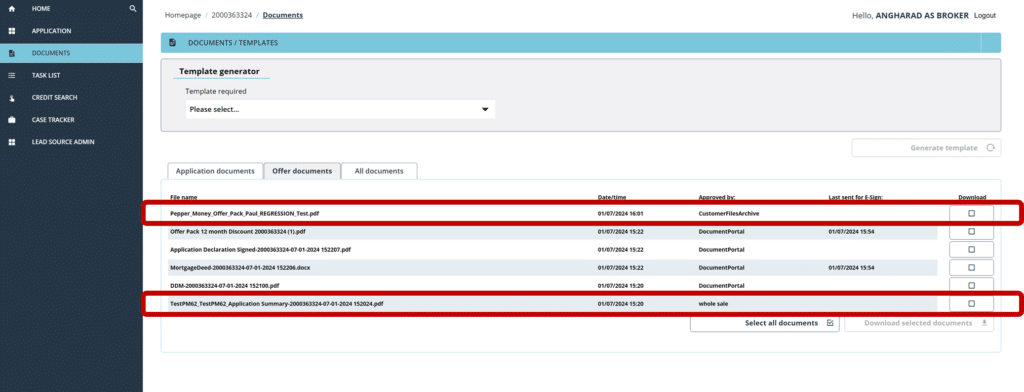

For cases eligible for e-signatures, post ‘Offered’ stage, you will be able to see when the offer documents were sent to Robertsons Solicitors by looking at the ‘Last sent for E-Sign’ column within the ‘Offer documents’ tab in SWAN.

Once the customer has e-signed their offer pack documents, we will check the documents to ensure that they are correct. Following this, you will continue to be notified that a case has moved from ‘Offered’ to ‘Awaiting Completion’.

To view/download the e-signed offer pack and Application Summary, please go to the ‘OfferDocuments’ section in SWAN where you will see a PDF copy of the Offer Pack and separate Application Summary.

Payout Before Consent Broker FAQs

We will payout before Consent is received where the First Charge lender is one of the twenty-one we have on our pre-defined list, the account is not in arrears and if Consent is the only outstanding item:

- Accord Mortgages

- Bank Of Scotland

- Barclays

- Birmingham Midshires

- Clydesdale Bank

- Cooperative Bank

- Coventry Building Society

- Halifax

- HSBC

- Kensington Mortgage Company

- Leeds Building Society

- Lloyds

- Nationwide

- Natwest

- Pepper Money*

- Royal Bank Of Scotland

- Santander

- Skipton Building Society

- TSB

- Virgin Money

- Yorkshire Building Society

Yes, it is still your (the brokers) responsibility to obtain Consent from the First Charge lender and submit it to us in a timely manner.

We will need to receive a copy of the First Charge lenders’ declined Consent.

We will contact you via email on days 3, 7 and 10 post–completion as a reminder. If Consent is still outstanding 10 days post-completion, we may attempt to contact you by telephone periodically for updates.

Despite being able to payout before Consent, we still need to obtain either the Consent or the declined Consent. If you do not respond or provide the Consent or declined Consent in a timely fashion, we reserve the right to remove the Payout Before Consent facility for future cases as well as potentially clawback any commission paid on the related case(s).

If the First Charge lender is Pepper Money, there are some further considerations to be factored in. If Engage Credit is on the Land Registry, we will not be able to payout before Consent. If the Pepper loan is a normal UKMLL registered charge, has an LTV of less than 85% and the loan has been running for longer than 6 months (with a clean payment history), we will be able to payout before Consent.

Yes, when we review the case we will raise the relevant To-Do item for Consent, which will include confirmation if it is Payout Before Consent or not.

- ‘First Mortgage Consent is required before Offer’ – This case is not eligible for Payout Before Consent and we require Consent to be provided before we can Offer.

- ‘First Mortgage Consent is required. Qualifies for pay-out before Consent’ – This case is eligible for Payout Before Consent and we require you to provide us with Consent as soon as possible.

- ‘Consent is incorrect – please provide correct First Mortgage Consent’ – This case was eligible for Payout Before Consent, Consent has been provided by you but there is an error with it and we require new Consent; we will inform you of the issue so you can obtain and provide us with new Consent.

As the case would have already been paid out, we will continue to honor the loan and your procuration fee.

Our BDMs

Lending criteria at a glance

- Market leading lender

- The majority of cases will not require valuation

- No matrix - each customers product is based on their individual circumstances

- Flexible approach to underwriting

- Ability to overpay without penalties

Referrals

If a case falls outside our standard criteria we may still be able to help.