General Questions

General questions, product related or case specific

Here are the answers to some frequently asked questions from our broker partners that could help you as a firsts or seconds intermediary

Product type

Residential and Buy to Let mortgages

General questions

We’re an award-winning UK mortgage lender, backed by a global financial institution.

We help people who may have been let down by high street lenders or are getting back on their feet financially after a major life event. Because the cases we handle can be complicated, we only do business through mortgage brokers.

If you’ve got an interesting case that involves one or more of these things, we may be able to help:

- Previous financial difficulties

- Accidental missed payments

- Self-employment

- Complex income

- Limited credit history

You can register using our online form, it’s quick and easy so should only take a few minutes.

Once you’ve submitted the registration form you’ll receive an email to verify your account – please click on the link within this email, otherwise, you won’t be able to log in.

If you’re the first person within your company to register with us we’ll also need to verify your company. In most situations we’ll be able to do this within minutes of the registration, however, there may be times this will take longer.

At the moment, we don’t lend on properties in Scotland or Northern Ireland.

However, if your client is looking to buy in England, Wales or on the Isle of Wight, we can help.

We use Equifax credit reports when assessing a mortgage application.

We use Equifax credit reports when assessing a mortgage application.

If your client fails Electronic Identification, we will notify you of any documents required in the Application Portal.

Product related

For our 2 year products it is 140% x (for standard BTL) or 125% x (for Limited Company BTL) the highest of:

- pay rate + 2%

- reversion rate

- 5.5%

We stress our 5 year products at (for standard BTL) or 125% x (for Limited Company BTL) pay rate.

No stress is applied to any of the other properties in an applicant’s portfolio as long as they can evidence the rental income covers the mortgage payments.

Yes. Check below for eligibility and how to apply.

Who can apply for a Product Transfer?

• Residential mortgage customers only (you can apply up to 3 months before their current initial rate ends).

• Provided your mortgage payments are up to date and you’ve not missed a payment in the last 12 months you can be considered.

• You can’t make any other changes to your mortgage during this process and you’re just applying to switch your current rate.

How do I apply?

If you have a client with a Pepper Money mortgage coming to the end of their initial rate that meets our criteria, you can apply for a Product Transfer here.

The Product Transfer application process

• You can apply up to 3 months before the current initial rate ends.

• It’s a simple process with no affordability or credit checks or need to refresh your employment or income information.

• It’s fee free – no product fees, no need for a new valuation of the property or any legal fees.

Yes. We offer retention rates and strive to keep our rates as competitive as possible for all customers. Please review our Existing Customer range for more details.

We don’t offer mortgage porting but all our remortgages come with free legals using a reputable conveyancing firm.

Once the applicant pays the application fee you won’t be able to switch the case onto another product without re-submitting the application and paying the associated fees.

We don’t currently offer further advances.

We consider every request for a second charge to be added to a property that we hold the first charge on, on a case by case basis.

The simple answer is No.

We don’t currently offer any completely fee-free products but this is something we are considering so watch this space.

We don’t apply any stress to any of the other properties in an applicants portfolio as long as they can provide evidence that the rental income covers the mortgage payments.

The LMR or the Lender Managed Rate is a variable rate of interest which we set. We may use this as the reference for setting the variable interest rate we switch the mortgage to at the end of the initial product fixed rate period.

0.49%, correct from the 16th March 2020.

Yes. Our product information sheets detail our approach to meeting the Products & Services Outcome and Price & Value Outcome – Information for distributors of the Product.

This information is intended for intermediary use only and should not be provided to customers.

Credit related

We don’t rely on an automated credit score to make lending decisions, instead our underwriters review your clients credit file and supporting information to make a decision based on their individual circumstances.

Yes, our DIP uses a soft credit search so it has no impact on the applicant’s credit score or any future credit applications.

Our DIPs are valid for 30 days except where the product is withdrawn. When a product is withdrawn we’ll send an email confirming any submission deadlines.

Our offers are valid for 90 days from the date the offer was issued. If your client doesn’t complete within this timeframe you can apply for an offer extension. For details on this please see the next FAQ.

Yes, if your client is unable to complete within the original offer period (90 days from when the offer is issued) we can extend the offer.

In order to ado this we will need a new employers reference and to carry out an up-to-date credit search, or for self-employed applicants, we will require the latest month’s bank statement. We will also need the valuer to confirm the valuation remains unchanged.

Please note:

- We can only extend an offer once

- The maximum time the offer can be extended is 30 days

- We can’t extend an offer that has either more than a month or less than a week left before it expires

If your client doesn’t meet the above criteria, then the application will need to be re-submitted

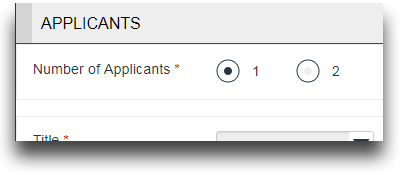

You can add a second applicant from the Applicant details stage of the DIP. At the top of the section, you’ll have to option to chose the number of applicants. Nothing changes when you select 2, but the application form will ask for the second applicant’s details after you’ve completed the details required on this screen.

You may find that you’re only given the option of 5 year products due to the affordability of the case in question.

On 2 year rates we apply a stress to ensure the applicant will be able to afford the mortgage if rates rise. However, on our 5 year rates the affordability is calculated at the pay rate.

We will instruct the valuation once we have assessed the case and are happy we can proceed. However, you can instruct the valuation before this point but the valuation fee will not be refunded if after reviewing the case we’re unable to proceed.

On 2 year rates we apply a stress to ensure the applicant will be able to afford the mortgage if rates rise. However, on our 5 year rates the affordability is calculated at the pay rate.

The easiest way to get a case update is by logging in to our application portal and sending us a secure message.

You can also give us a call on 03333 701 101 (lines are open 9am-5pm, Monday to Friday).

We’ll collect the application and valuation fee when you submit the application, this means there will be no delays once we’re ready to instruct the valuation. If the case doesn’t progress to a valuation we’ll refund this payment. The application fee is non-refundable.

Second charge mortgages

General questions

We’re a UK specialist lender, backed by a global financial institution.

We offer a range of variable, fixed and second charge mortgages. Our customers can apply are either through our carefully selected broker partners or directly from us.

Our second charge broker panel is currently closed.

We don’t currently lend for our second charge mortgage products in Northern Ireland but we do lend in mainland Scotland and some of the islands.

We use Equifax credit reports when assessing a mortgage application.

Commission is paid via EFT and the payment runs are twice weekly.

Product related

We’d be happy to review the case. Please submit a referral, by emailing the referral team at [email protected]

We will consider further advances once the account has been running for 6 months, subject to underwriting.

Yes, we will. We can lend on ex houses and flats on referral and pre-emption is ignored.

If there is a restriction on the land registry then we would require a letter of consent from the first charge lender.

Many cases can go through without the need for a valuation however if a valuation is required, we have a valuation panel that must be used.

Case specific

Offers are valid for 30 days. Extensions can be agreed by referral to the underwriter.

All updates are sent through our portal.

We will speak to all applicants prior to the mortgage offer being produced.

Resources

Our Intermediary tool kit has all the information you need

Service levels

Our latest service levels

Our latest Pepper Money service levels show how quickly we’re currently processing mortgage applications on behalf of our customers.

What we’re working on

Our call capacity (average)

Referrals

Working on DIP referrals received on:

Messages

Responding to application portal broker messages received on:

Reviews

Reviewing offer assessment sent to our underwriters on:

Applications

Working on applications received on:

Valuations

Currently reviewing valuations received on:

Calls

Answering calls in less than (average speed):