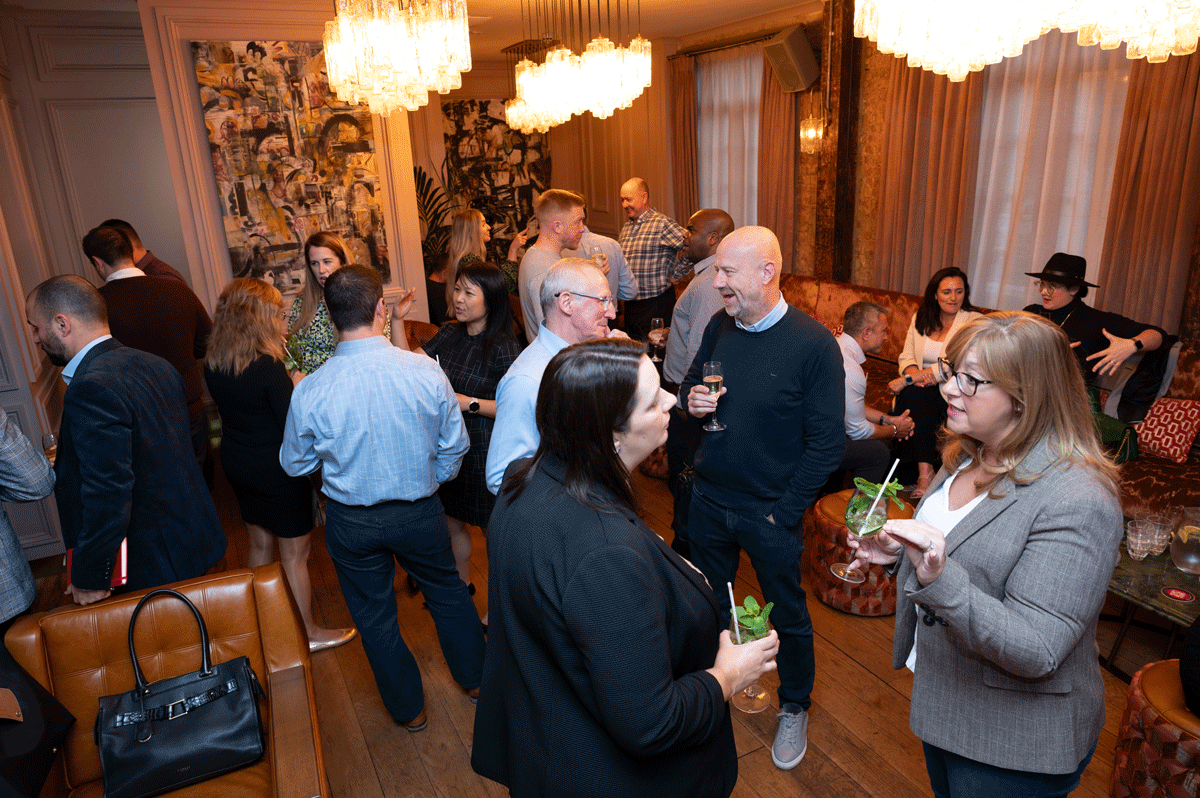

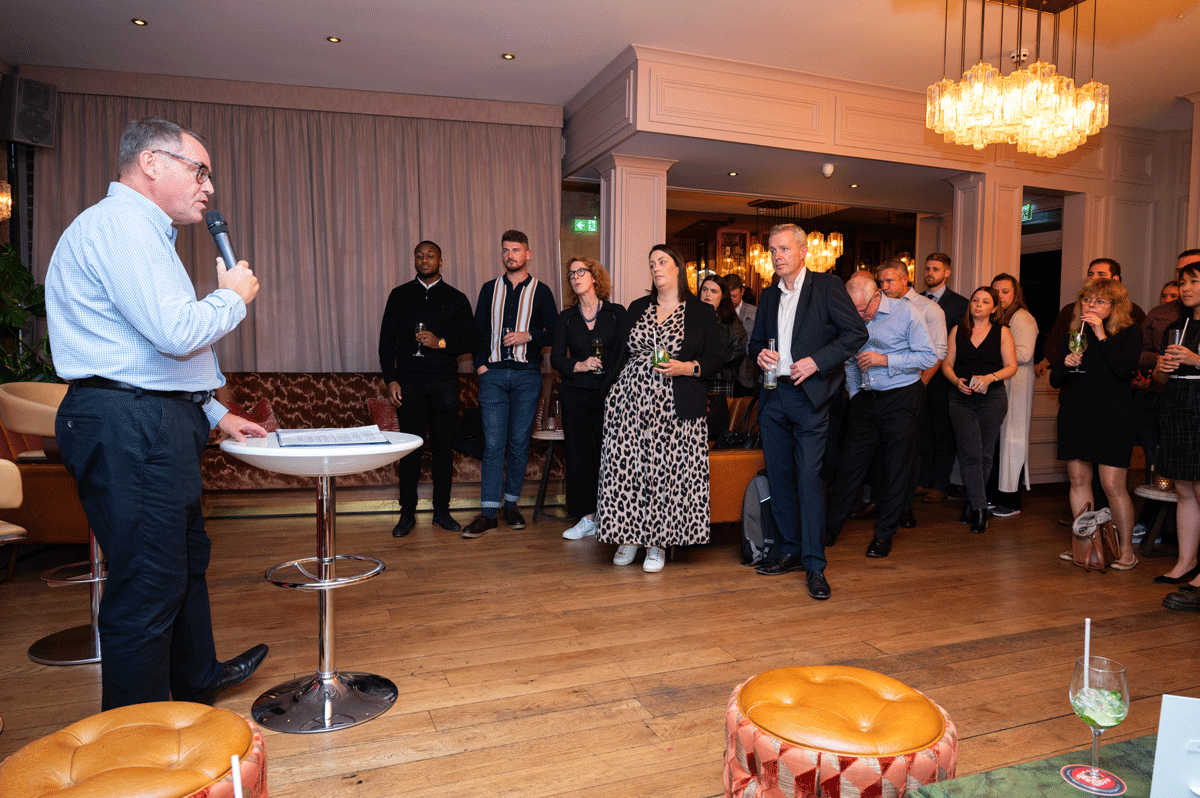

On Wednesday, 11th of October, Pepper Money hosted an exclusive event in London for industry experts, distribution partners, and journalists to preview the latest findings from The Specialist Lending Study.

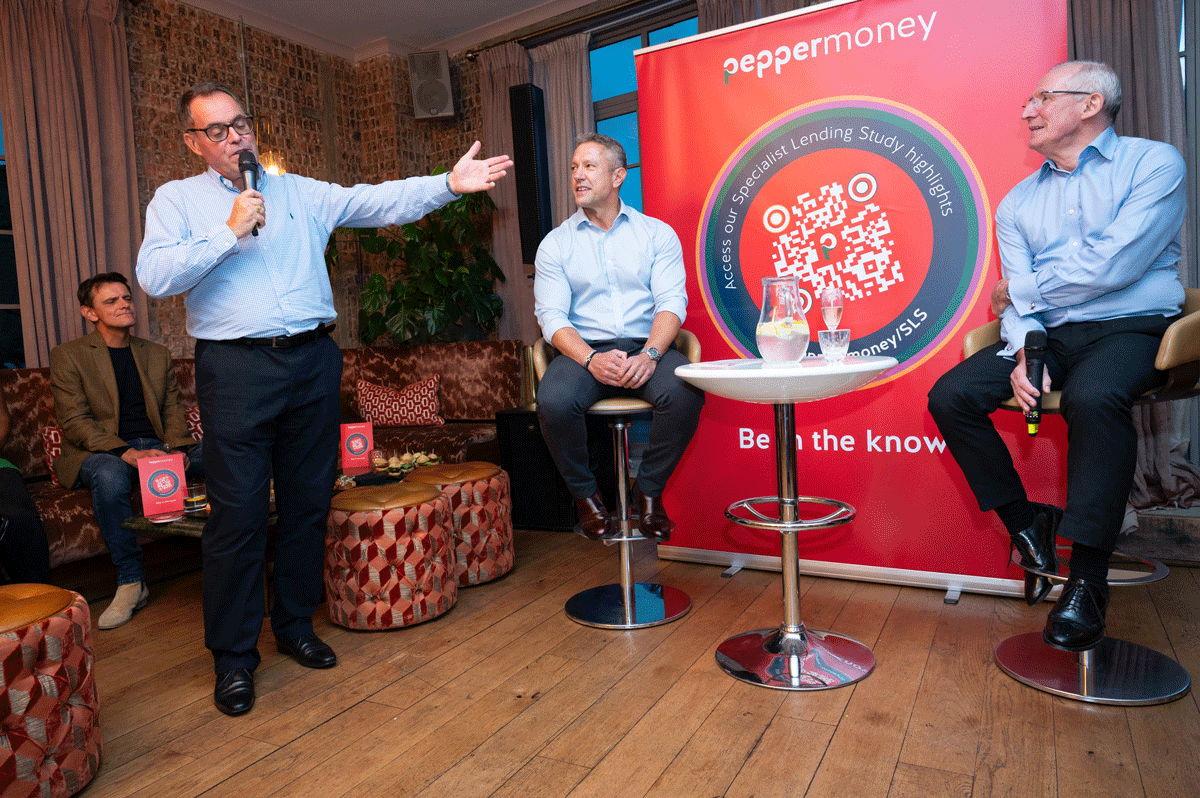

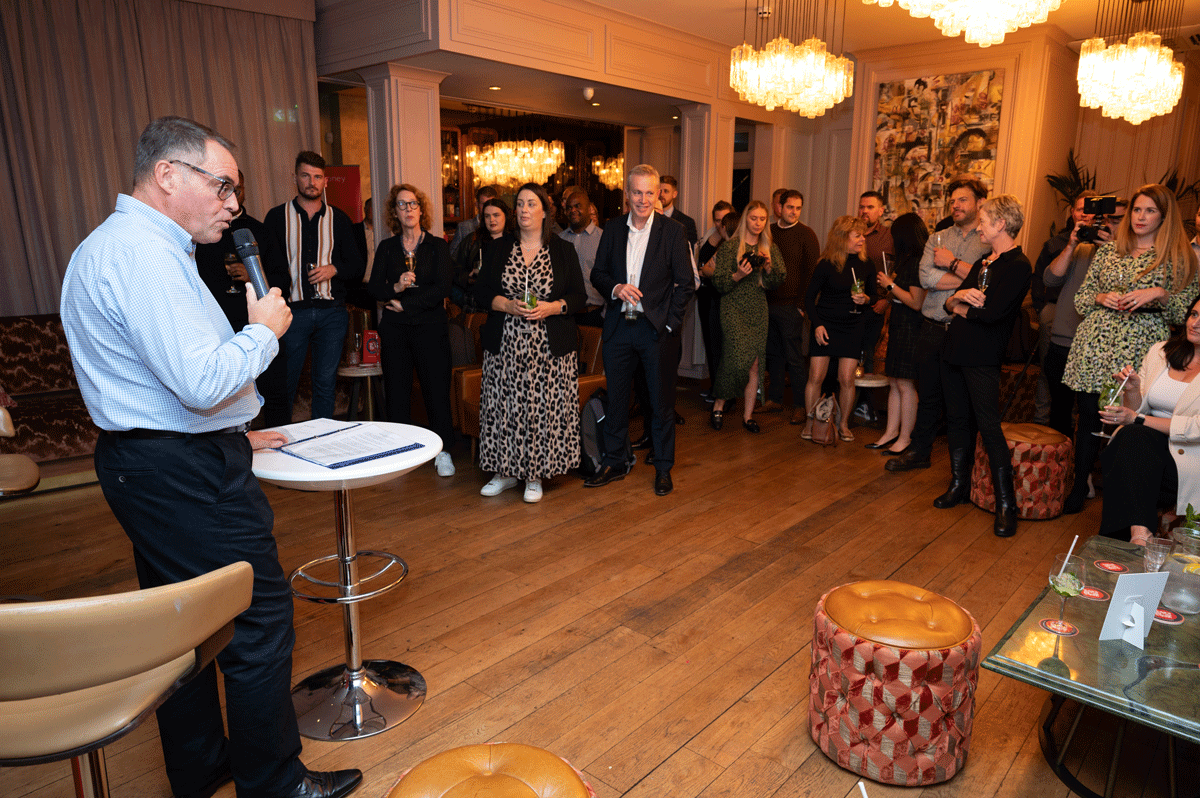

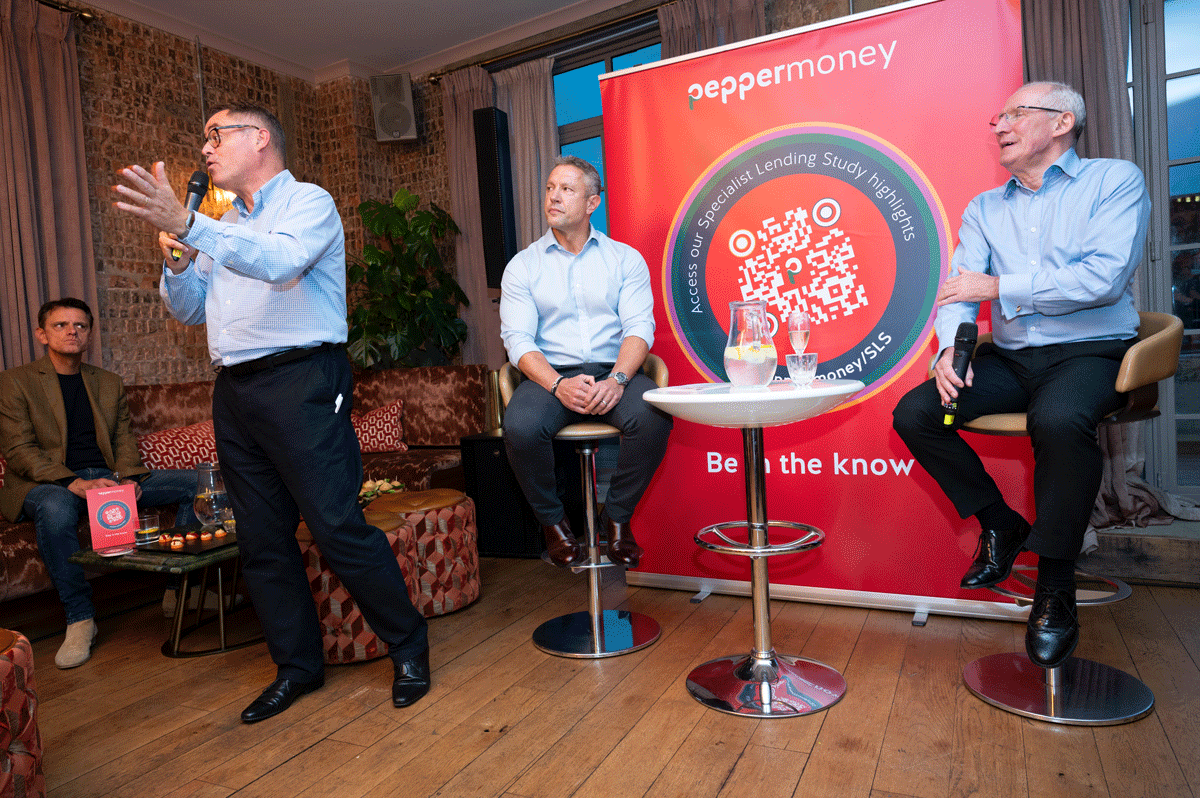

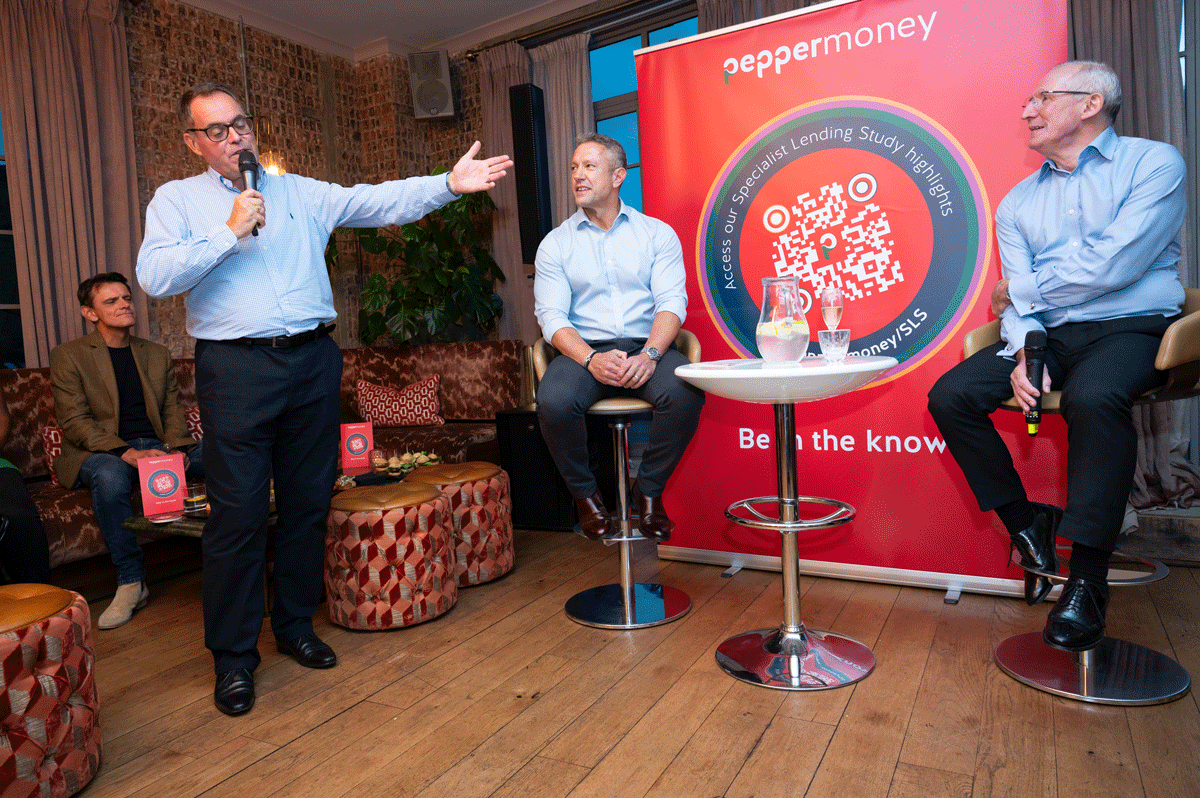

Attendees were treated to a welcome address from Intermediary Relationship Director, Rob Barnard, where he shared some of the key highlights from the study.

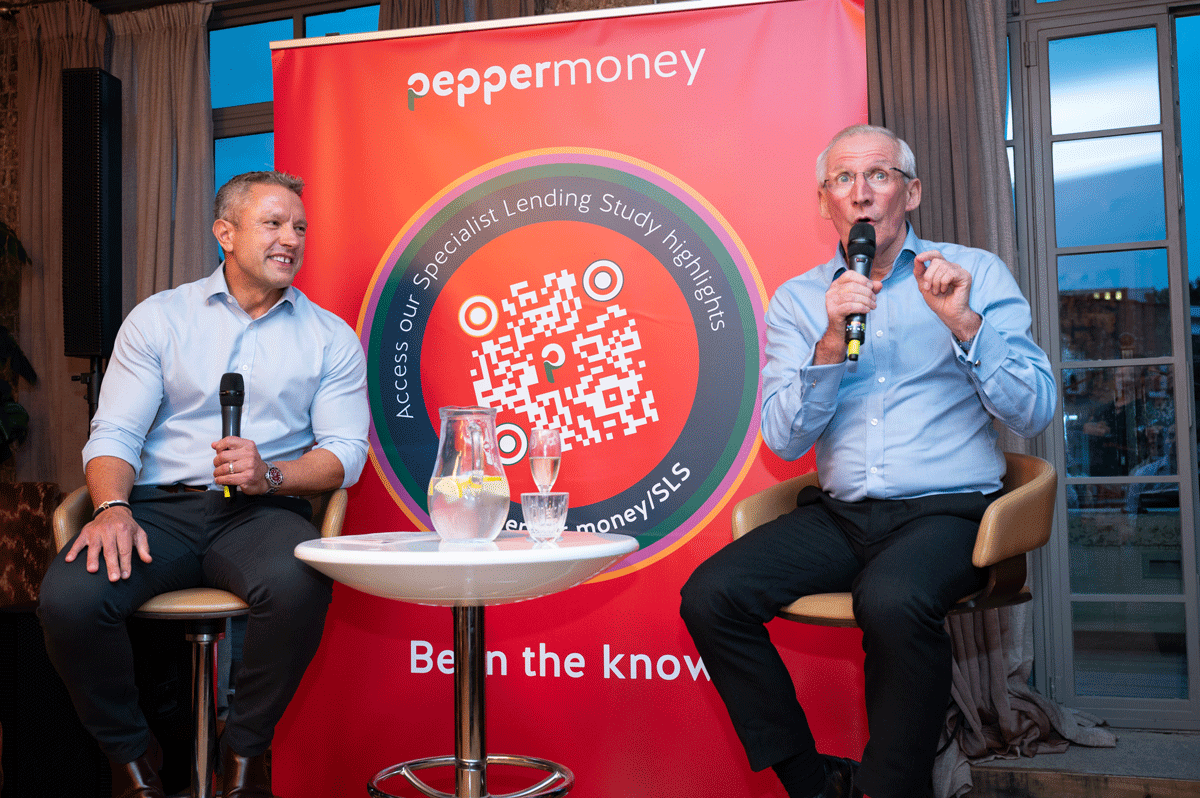

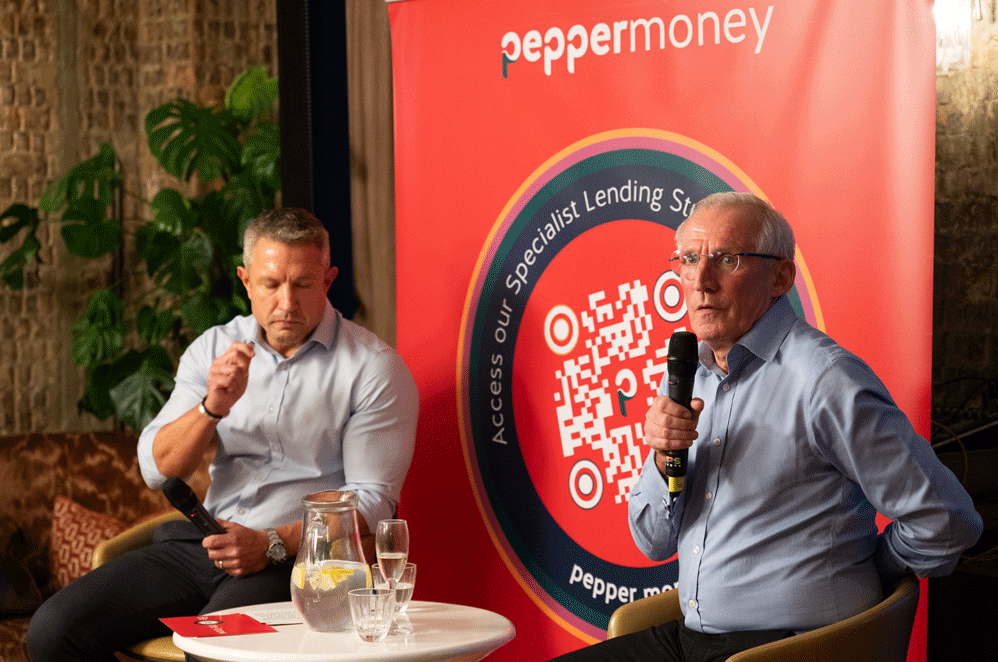

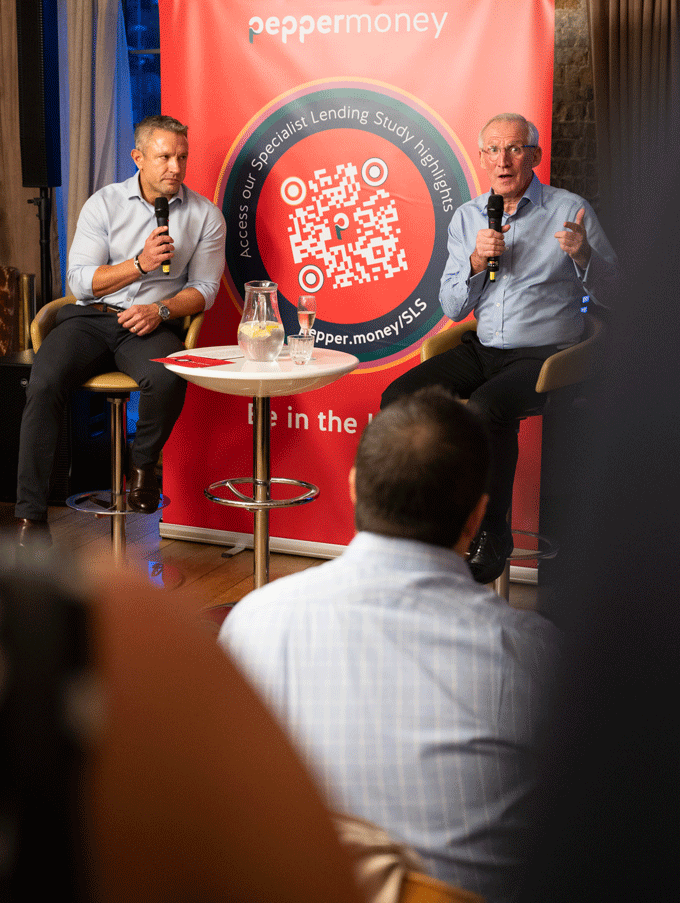

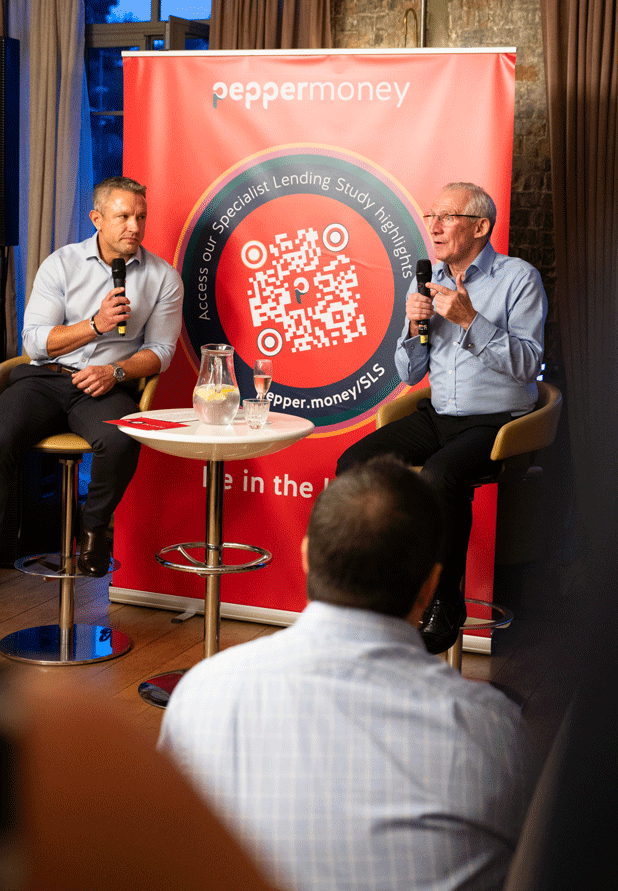

This was followed by an insightful conversation with Sales Director, Paul Adams, and a very special guest, Robert Sinclair, CEO of AMI. Together, they discussed what the findings mean for brokers and the specialist market more broadly in the coming year, this discussion was then opened up to the floor to answer questions.

Paul Adams, said, “It was a unique opportunity to have industry influencers together with the expert voice of mortgage intermediaries, Robert Sinclair, to share some of the key insights from our latest Specialist Lending Study.

When this is published in the coming weeks, I am sure you’ll agree that it points to a ‘significant opportunity’ for mortgage brokers everywhere to set their stall out to support a growing population of people who need their expertise in navigating through the plentiful options available to them.

We know that finding the right mortgage broker can make financial dreams a reality and for brokers, a client for life…!”

Paul Adams

Pepper Money Sales Director

However, the study uncovered that there remains a significant proportion of adverse customers who will not seek advice from a broker. In addition, even more concerning is some customers are not aware that there are Specialist Mortgages that could be a more suitable option for them.

This is now Pepper Money’s seventh study of this kind, with the first being released back in the autumn of 2019. The study was originally launched as the Adverse Credit Study, with the primary objective of understanding the impact of adverse credit on UK consumers to educate brokers on this growing area of the specialist mortgage market.

In order to do this, Pepper Money work with YouGov to conduct research amongst a demographically representative sample of the British adult population to ensure the results are statistically robust. This year’s study surveyed more than 6,000 people.

In recent years, Pepper Money has broadened its research and renamed it the ‘Pepper Money Specialist Lending Study’. This helps acknowledge that adverse credit is just one factor that could see a customer’s mortgage application being declined.

Snippets from the study and the event have been shared on Pepper Money’s website and social media accounts, and the full report will be released in the upcoming weeks.