High street lenders have traditionally taken a restrictive view of lending to the self-employed, requesting at least three years’ audited accounts and taking an average consideration of those three years when assessing affordability.

Previous rejections from high street mortgage lenders for reasons including lack of recent tax returns, irregular or insufficient income, for example, are reasons why more than a third of self-employed people decided not to submit an application for a mortgage or remortgage in the last 5 years, according to research.

But specialist lenders have risen to the growing demand for mortgages from self-employed borrowers, and now offer real choice to customers who run their own business.

Mortgage demand from the self-employed is growing

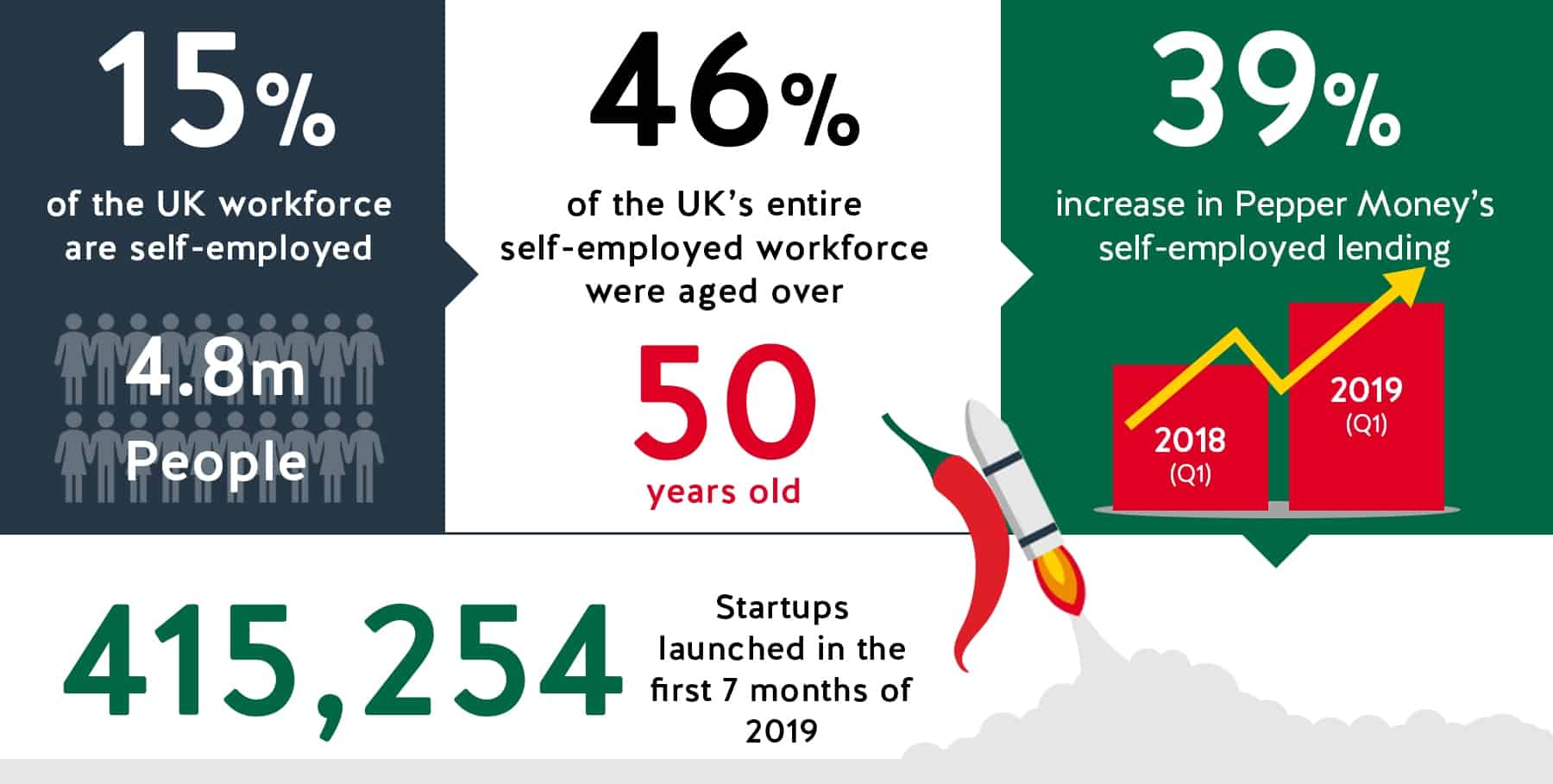

With the number of self-employed people growing, so is the demand for mortgages from them. According to the Office of National Statistics, self-employment accounts for 15% of the UK workforce, which equates to 4.8 million people.

The first seven months of 2019 alone saw the launch of 415,254 start-up businesses according to Startupbritain.org. Whilst not all of these start-ups will survive and thrive, many will, and they will add to the growing population of self-employed business owners.

It’s not just younger people who are becoming entrepreneurs. In the first three months of 2019, more than 46% of the UK’s entire self-employed workforce were aged over 50, according to Rest Less, and it seems a growing number of workers are recognising the advantages and flexibility of self-employment as a way of continuing to work beyond traditional retirement age.

Making business owners, home owners

With an ongoing rise in self-employment, along with our enhanced proposition for the self-employed, our lending to self-employed applicants increased in the first quarter of 2019 by 39% compared to the same period in 2018. We were able to do this by meeting the growing demand from self-employed borrowers with an individual and constructive approach to underwriting every application.

We can lend to self-employed customers based on just one year’s accounts and three months’ business bank accounts. For sole traders we can also accept SA302 to evidence income and, where applicants own 100% of the company, we can consider income additions such as directors’ car allowance, directors’ pension contribution, use of home as an office, private health insurance.

There’s no reason why your self-employed clients should be worried about having their mortgage application rejected just because they are self-employed.

We want to help business owners become home owners, so if you have a self-employed client, give us a call.

All figures correct at the time of publishing.